Building a solar module factory is a significant undertaking. It requires a clear vision and a robust financial model that can stand up to the scrutiny of investors, banks, and board members.

Transforming ambition into a bankable business case is the critical first step, yet it is often the most complex. Many promising projects fail at this stage, not for a lack of potential, but due to an incomplete understanding of the financial journey ahead.

This guide provides that clarity. We’ll walk you through the essential components of a sound financial plan, drawing on over 25 years of experience launching successful solar manufacturing ventures worldwide. Here, you will find a structured approach to understanding your investment, from initial capital expenditure to long-term return.

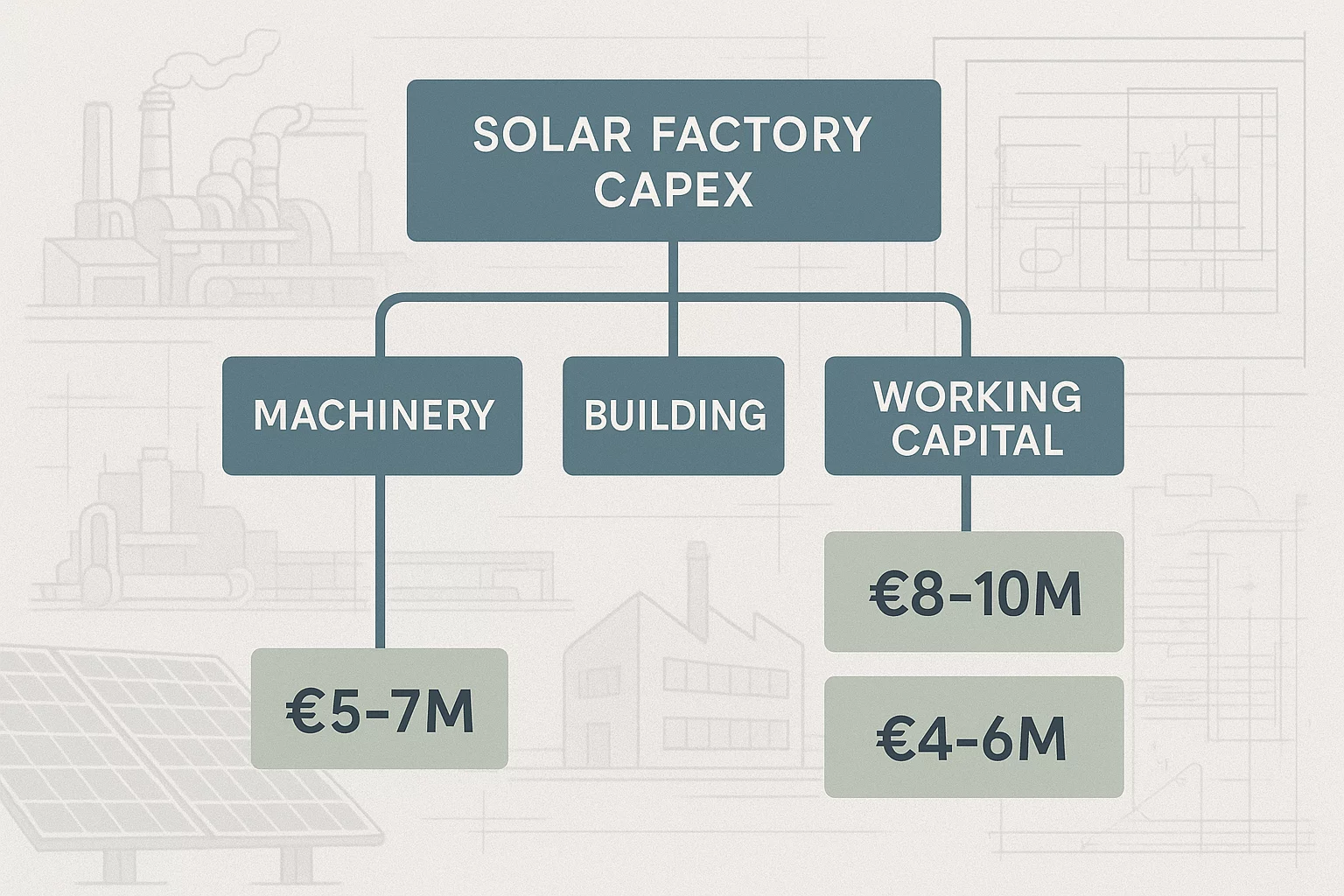

Deconstructing Your Capital Expenditure (CapEx)

Your Capital Expenditure, or CapEx, is the total upfront investment needed to take your factory from an idea to a fully operational facility. A precise and comprehensive CapEx forecast is the foundation of your entire business model, typically broken down into three main categories.

1. Production Machinery

This is the core of your factory. The cost will vary based on your target capacity and chosen technology. For a modern, 100 MW production line, a realistic investment for machinery is between €8–10 million. This includes everything from stringers and laminators to testing and framing equipment. Choosing the right equipment isn’t about finding the cheapest option; it’s about securing reliability and efficiency for the long term.

2. Building and Infrastructure

Your facility must be equipped to house a sophisticated manufacturing process. This includes not just the physical building but also the necessary electrical systems, compressed air supply, and climate control. A suitable industrial building, either new or retrofitted, can require an investment of around €1.5 million. Proper infrastructure planning prevents costly delays and operational bottlenecks down the line.

3. Working Capital

Often underestimated, working capital is the lifeblood of your operation once production begins. These are the funds needed to cover the initial inventory of raw materials—solar cells, glass, frames—and other operational costs before you generate revenue from your first sales. For a 100 MW factory, you should budget approximately €800,000 for initial working capital to ensure a smooth start.

Forecasting Your Operational Expenditure (OpEx)

Once your factory is running, your focus shifts from one-time investments to ongoing operational costs, or OpEx. A clear understanding of these recurring expenses is essential for pricing your modules correctly and managing profitability.

The single most important factor in OpEx is raw materials. In solar module manufacturing, materials typically account for over 95% of the total operational cost. This makes supply chain management a critical pillar of your business strategy. The primary material costs include:

- Solar Cells: The most significant component, representing around 40% of material costs.

- Glass: The front sheet of the module, accounting for approximately 20%.

- Aluminum Frames: The structural component, making up about 14% of the cost.

The remaining operational expenses—labor, utilities (primarily electricity), maintenance, and other overheads—must also be carefully managed. While smaller in comparison, these costs directly impact the profit margin on every module you produce.

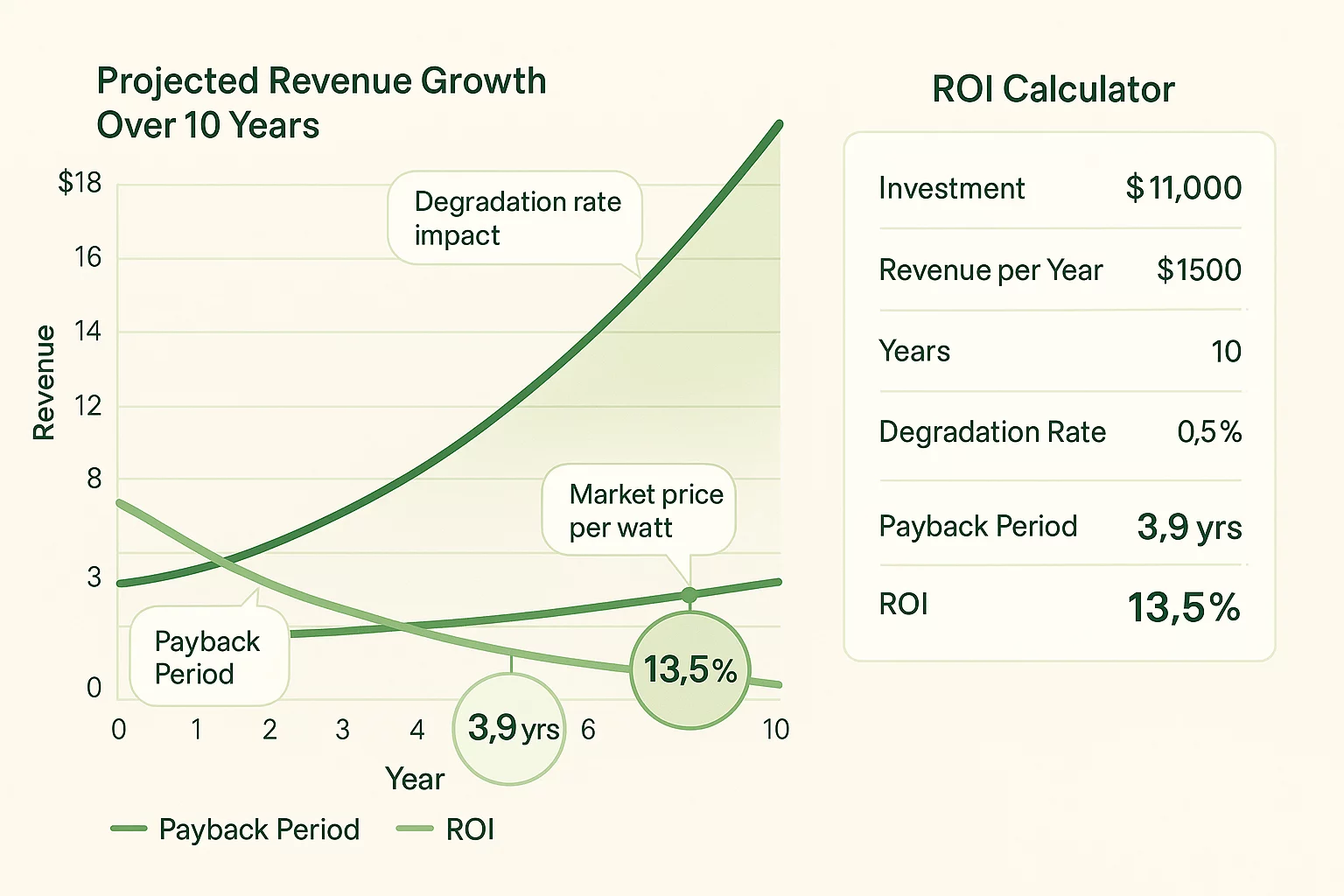

Projecting Your Revenue and Return on Investment (ROI)

With a clear picture of your costs, you can begin to project revenue and calculate the long-term viability of your investment. Your revenue will depend on your factory’s annual output (in watts), the efficiency of your modules, and the prevailing market price per watt in your target region.

The key metrics investors will want to see are the payback period and the return on investment. While every project is unique, industry benchmarks provide a useful reference point. On average, commercial solar projects can achieve an ROI of around 13.5%, with a typical payback period of 10.5 years.

A thorough financial model will project these figures over a 10-year horizon, accounting for factors like module degradation, potential fluctuations in material costs, and market price trends. This approach provides a realistic, dynamic view of your factory’s financial performance over time.

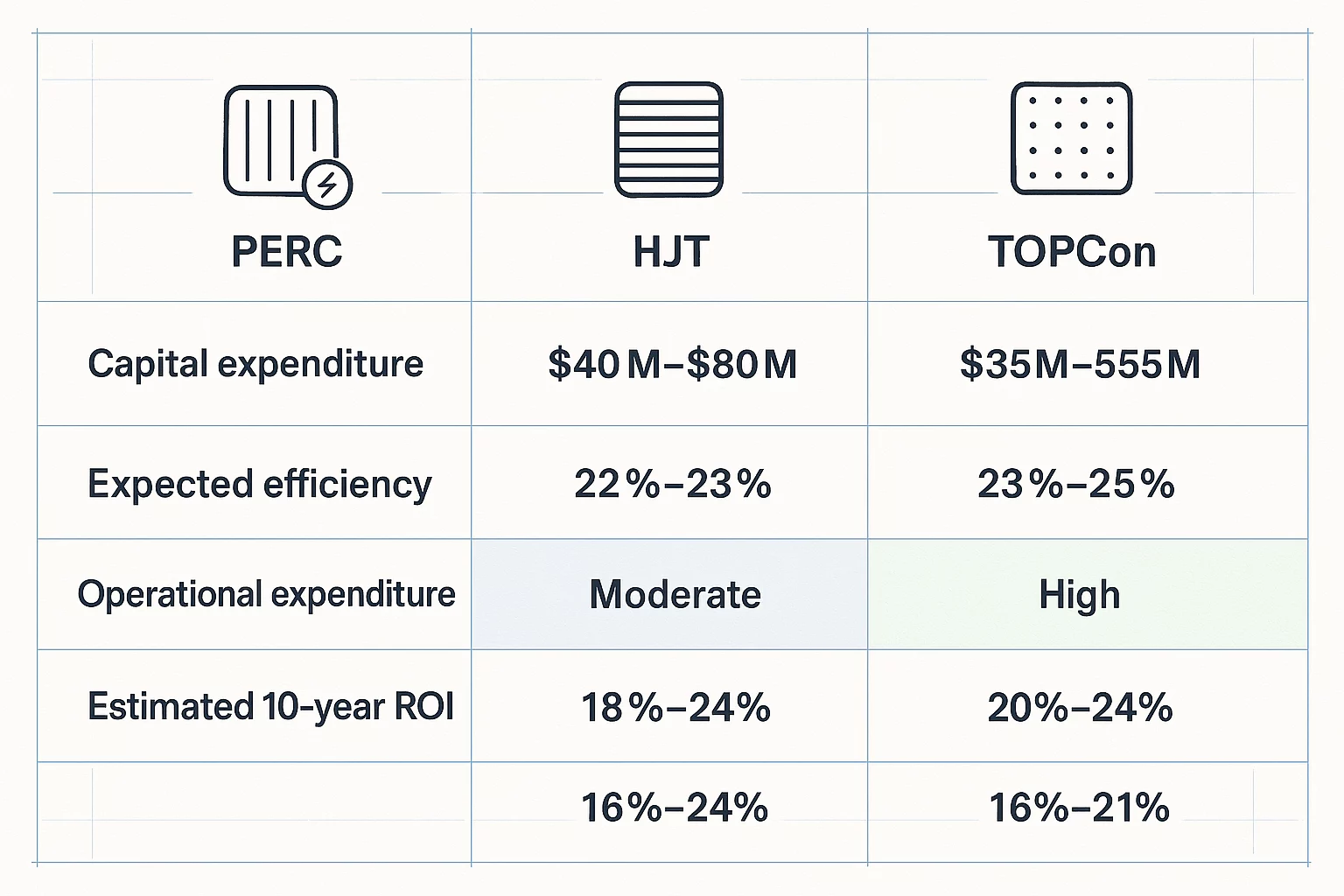

The Technology Decision: How Your Choice Impacts the Bottom Line

The technology you choose for your production line—such as PERC, HJT, or TOPCon—is more than a technical detail; it is a fundamental financial decision. Established technologies like PERC offer a lower initial CapEx and a proven track record. However, emerging high-efficiency technologies like HJT and TOPCon, while requiring a larger upfront investment, can deliver higher power output per module.

This creates a strategic trade-off. A higher-efficiency module can command a premium price and deliver better long-term returns, potentially improving your overall ROI. Your choice should align with your business strategy, target market, and long-term financial goals. Analyzing the cost-versus-efficiency balance is a critical part of building a future-proof business plan.

Beyond the Numbers: Building a Bankable Business Plan

A financial model provides the quantitative backbone of your project, but a truly bankable business plan requires more. Investors and financial institutions need to see that your numbers are grounded in a sound operational strategy. This means demonstrating a clear understanding of your target market, a resilient supply chain for raw materials, and a competent team to manage operations.

The financial projections are the destination, but the plan for market entry, logistics, and quality control is the roadmap that proves you can get there. This is where an experienced partner becomes invaluable—not just to supply machines, but to help you build the comprehensive strategy that turns a financial model into a real, profitable enterprise.

Frequently Asked Questions

How should I account for the volatility of market prices for solar modules?

A conservative approach is always best. Your financial model should include sensitivity analysis, showing how profitability is affected by different price scenarios. A strong focus on production efficiency and cost control provides a buffer against market fluctuations.

What is the biggest hidden cost when starting a solar factory?

Beyond the initial machinery investment, the most commonly overlooked costs are sufficient working capital and the expenses related to managing the supply chain. Delays in raw material shipments can halt production, making a well-funded and well-planned logistics strategy essential.

Can a smaller factory, such as 25 MW, be profitable?

Absolutely. Profitability is not solely a function of scale. Smaller factories can be highly successful by targeting niche, high-value markets, focusing on specialized products, or serving a local region where they have a logistical advantage. The strategy must be tailored to the scale.

Why is ongoing support more important than the initial machine price?

The purchase price of your equipment is a one-time event, but production is a daily process for decades. Ongoing support ensures you can maintain high uptime, optimize your production processes, and adapt to new challenges. An experienced partner who stays with you is an investment in your factory’s long-term success, not just its initial setup.

Let Us Help You Build Your Business Case

Developing a financial model is a detailed process, but you don’t have to do it alone. With our experience launching factories across the globe, we can help you build a realistic and compelling business case tailored to your specific vision and market.

We invite you to discuss your project with us. Let’s explore what is possible together.

Contact us to build your bankable business case.