When considering an investment in solar module manufacturing, one of the first and most critical questions is about scale. Is it wiser to begin with a nimble 50 MW production line, or invest in a large-scale 250 MW facility from the outset?

The answer isn’t simply about the initial capital required; it’s about understanding the fundamental relationship between investment, operational costs, and the time it takes to achieve profitability.

This analysis breaks down the dynamics of breakeven points and payback periods for these two common factory sizes. It’s designed to move beyond abstract numbers and provide a strategic framework for your decision-making.

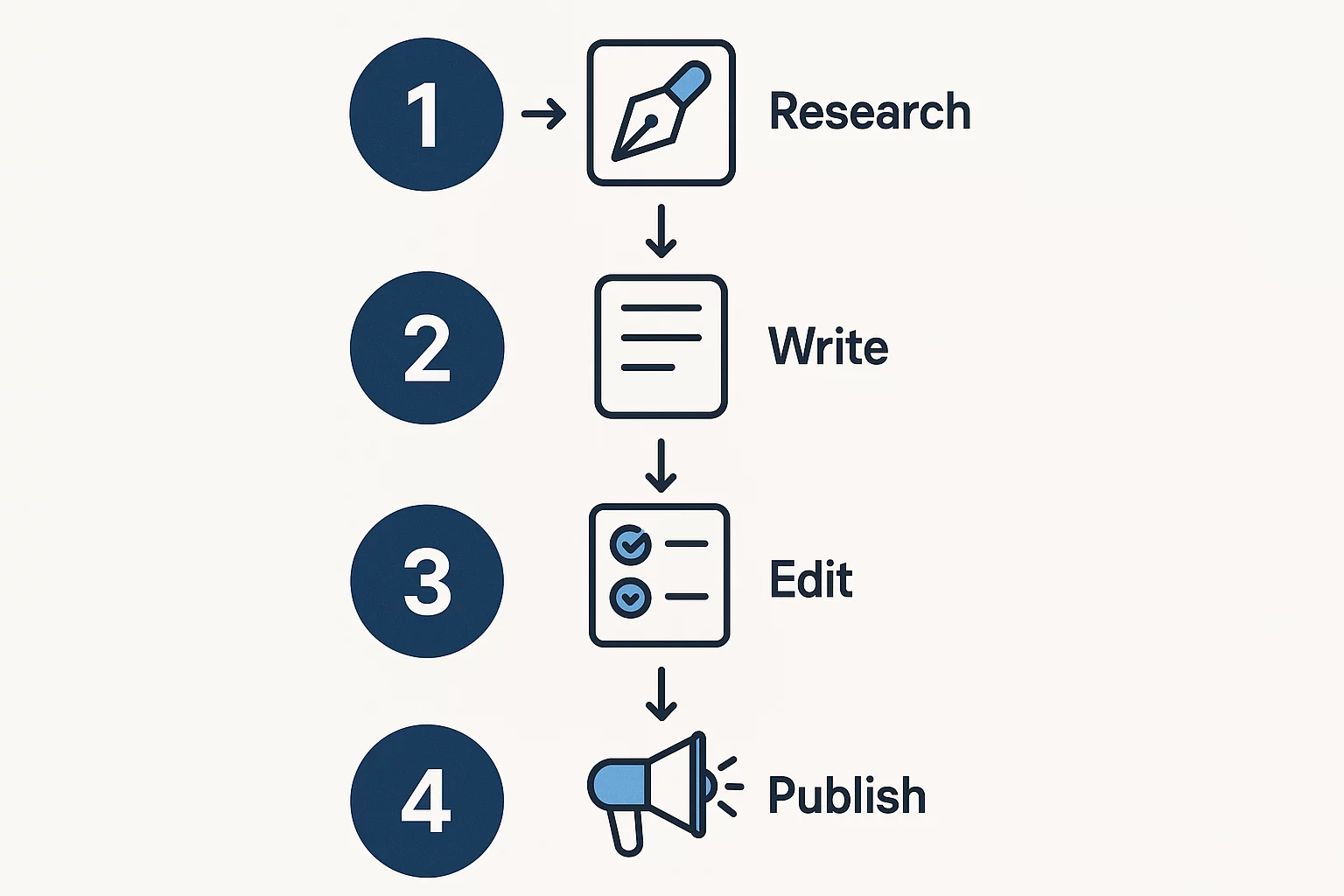

Understanding the Core Financial Concepts

Before comparing the two models, let’s define the key metrics that will guide our analysis. These concepts provide a roadmap from initial investment to sustained profit.

The Breakeven Point

The breakeven point is, simply, the moment when your total revenue equals your total costs. At this point, you’re no longer losing money, but you haven’t yet made a profit. It’s the crucial milestone where the business becomes self-sustaining.

Calculating this requires a clear understanding of your fixed and variable costs relative to the revenue generated per unit—in this case, per solar module sold.

The Payback Period

The payback period answers a different but equally important question: ‘How long will it take to earn back the initial investment?’ This metric measures the time required for the project’s net cash flows to equal the original capital expenditure (CAPEX).

For investors, a shorter payback period often signifies a less risky and more attractive venture.

The Key Variables in Solar Manufacturing

The profitability of a solar module factory hinges on a complex interplay of costs and revenues. The primary factors influencing both the breakeven point and the payback period are capital expenditure, operating expenses, and revenue.

-

Capital Expenditure (CAPEX): This is the total upfront investment required to build and commission the factory. It includes the cost of production machinery, factory construction or renovation, installation, and initial training. Naturally, the CAPEX for a 250 MW line is significantly higher than for a 50 MW line.

-

Operating Expenses (OPEX): These are the day-to-day costs of running the factory. The largest components of OPEX in solar manufacturing are raw materials (like silicon wafers, glass, and encapsulant films), labor, electricity, and routine maintenance.

-

Revenue: Revenue is generated from the sale of finished solar modules. It depends on the factory’s production volume (its megawatt capacity) and the prevailing market price per watt for the modules produced.

Understanding how these variables behave at different scales is key to making an informed investment decision.

A Comparative Model: 50 MW vs. 250 MW

Let’s apply these concepts to our two factory models. While exact figures depend on location, technology, and market conditions, this comparison illustrates the fundamental principles of economies of scale.

The 50 MW Production Line: Strategic Agility

A 50 MW facility represents a more conservative entry into the market. Its primary advantages are a lower initial capital investment and a faster path to becoming operational.

-

Lower CAPEX: The upfront investment is substantially smaller, making financing more accessible and reducing initial financial risk.

-

Faster Breakeven: Although the profit per module may be lower than in a larger factory, the significantly lower fixed costs (like depreciation and debt service) mean the factory can reach its breakeven point with a smaller sales volume.

-

Flexibility: A smaller line can be more agile, capable of adapting to serve specific regional markets or produce specialized, high-margin modules without requiring massive sales volumes.

However, the 50 MW line will have a higher cost per watt produced due to less purchasing power for raw materials and less efficient overhead absorption.

The 250 MW Production Line: Power of Scale

A 250 MW facility is a major industrial undertaking designed to compete in high-volume markets.

-

Higher CAPEX: This model requires a significant upfront investment, which entails higher financial risk and a more complex financing process.

-

Economies of Scale: The primary advantage is a drastically lower cost-per-watt. Bulk purchasing of raw materials, optimized logistics, and the efficient use of labor and automation lead to superior operating margins.

-

Longer Payback Period (Potentially): Despite higher profitability per unit, the sheer size of the initial investment means it will take longer to recoup the full capital outlay. Once the payback period is complete, however, the long-term profit potential is substantially greater.

The following chart illustrates how a larger facility, despite higher initial costs, can achieve a lower cost per unit, which alters the profitability curve over time.

This model shows that while the 50 MW line breaks even sooner in terms of time and volume, the 250 MW line operates from a much lower cost base, promising greater profitability once the higher production threshold is met.

Beyond the Numbers: Strategic Considerations

Your decision shouldn’t be based on financial models alone. The right choice depends entirely on your business strategy, market conditions, and long-term vision.

-

Market Risk: A 50 MW facility may be better insulated against regional market downturns or intense price competition, as its survival does not depend on massive sales volumes.

-

Phased Growth: Many successful entrepreneurs begin with a smaller line to establish a market foothold, prove their business model, and build operational expertise. This initial phase then lays the groundwork for future expansion, transforming the investment into the first step of a long-term strategic partnership.

-

Financing and Investment: A smaller project is often more appealing to investors and banks, as it presents a more manageable risk profile and a clearer, shorter path to initial returns.

Common Pitfalls to Avoid

In our 25+ years of experience, we’ve seen investors make critical miscalculations. Building a successful manufacturing operation requires looking beyond the initial machinery quote.

-

Focusing Only on CAPEX: A cheap production line can become incredibly expensive if it’s inefficient, unreliable, or produces low-quality modules. This directly impacts OPEX and revenue for years to come.

-

Underestimating OPEX: The cost of raw materials can fluctuate significantly, and a robust business plan must account for these dynamics. Energy consumption and skilled labor are also major cost centers that cannot be ignored.

-

Ignoring the Human Factor: The success of your factory depends on a well-trained, efficient team. The right partner doesn’t just deliver machines; they ensure your people are prepared to run them effectively from day one.

Ultimately, your factory’s performance stems directly from the quality of its equipment, the efficiency of its processes, and the expertise of its operators.

Frequently Asked Questions

-

What is the typical payback period for a solar module factory?

This varies widely based on location, electricity costs, labor costs, and module prices. As a general guide, payback periods often range from 3 to 7 years. A smaller 50 MW line is typically at the shorter end of this range, while a larger 250 MW line may be at the longer end due to the size of the initial investment. -

How does the choice of technology affect profitability?

Higher-efficiency module technology (like TOPCon or HJT) commands a higher price per watt on the market. While the production machinery may be more expensive, the increased revenue can significantly improve margins and shorten the payback period. -

Does the location of the factory have a major impact?

Absolutely. Location affects labor costs, energy prices, logistics for raw materials and finished goods, and potential government incentives or import tariffs. A thorough site selection analysis is a critical step in the planning process. -

Can I start with a 50 MW line and expand to 250 MW later?

Yes, and this is a very common and prudent strategy. A phased approach allows you to enter the market with lower risk, build cash flow, and then reinvest profits into expansion. It’s crucial to plan the initial factory layout with future growth in mind.

Your Vision, Our Experience

Choosing the right scale for your solar manufacturing venture is a decision with long-term consequences. There is no single ‘best’ answer—only the one that’s best for your specific goals, market, and financial framework. The key is to partner with an experienced team that can provide transparent guidance drawn from decades of real-world projects.

Our experienced team is ready to help you develop a comprehensive business model tailored to your vision. Contact us to get the clarity you need and invest with confidence.