Imagine two entrepreneurs evaluating the same proposal for a new solar module factory. The equipment costs are identical, the market potential is the same, and the operational projections are sound. The first entrepreneur’s financial model shows a respectable but long 10-year payback period. The second, however, presents a model with a 5-year payback.

What made the difference? The second entrepreneur understood a critical truth: a project’s true return on investment isn’t calculated in a vacuum. It’s shaped by the real-world financial landscape, including the powerful impact of government incentives. For investors and energy leaders, overlooking these programs is like navigating with only half a map.

Beyond the Balance Sheet: Why Incentives Are a Strategic Tool, Not an Afterthought

Governments worldwide are aggressively promoting local manufacturing to secure their energy independence, create jobs, and decarbonize their economies. The International Energy Agency (IEA) reports that global solar PV manufacturing capacity is set to more than double by 2024, driven heavily by government policies in key regions.

These policies are not just abstract goals; they translate into tangible financial support for projects like yours. Factoring in these incentives is not merely an accounting exercise; it is a fundamental part of your strategic planning. A project that appears marginal on paper can become highly profitable and strategically vital when local support is integrated into the financial model. This changes everything—from your ability to secure financing to the speed at which your venture becomes a profitable, self-sustaining operation.

A Practical Guide to Identifying Solar Manufacturing Incentives

While specific programs vary by country, they generally fall into three main categories. Understanding these types will help you identify opportunities in your region.

Direct Financial Support

These are the most straightforward incentives, as they directly impact your cash flow and reduce your initial capital outlay.

- Capital Grants: Direct, non-repayable funds provided to help cover the initial investment in land, buildings, or equipment (Capital Expenditures, or CapEx).

- Production Subsidies: Payments received per unit (e.g., per megawatt) of solar modules produced. This creates an additional revenue stream and directly rewards output.

- Low-Interest Loans: Government-backed financing offered at below-market rates, significantly reducing the long-term cost of borrowing.

Tax-Based Incentives

These programs reduce your tax burden, increasing your net profit and improving your project’s overall financial performance over time.

- Tax Holidays: A complete exemption from corporate income tax for a set number of years (often 5-10 years) after your factory begins operation.

- Investment Tax Credits (ITCs): A direct reduction of your tax liability based on a percentage of your initial investment, which accelerates your payback period.

- Accelerated Depreciation: Allows you to deduct the cost of your equipment from your taxable income more quickly than standard accounting rules permit, freeing up cash flow in the early years.

Indirect Support

Often overlooked, these non-monetary incentives can be just as valuable by reducing risk, saving time, and lowering operational costs.

- Land and Infrastructure: Providing land at a reduced cost or for free, and ensuring access to critical infrastructure like roads, water, and reliable electricity.

- Streamlined Permitting: A ‘fast-track’ process for obtaining the necessary permits and licenses, which can save months or even years of administrative delays.

- Workforce Training Programs: Government-funded initiatives to train a local workforce with the specific skills needed for solar manufacturing, reducing your hiring and training costs.

From Potential to Profit: Quantifying the Impact on Your ROI

Once you have identified potential incentives, the next step is to translate them into concrete numbers within your financial model. A vague awareness of this support is not enough; you must quantify its impact to understand your project’s true potential.

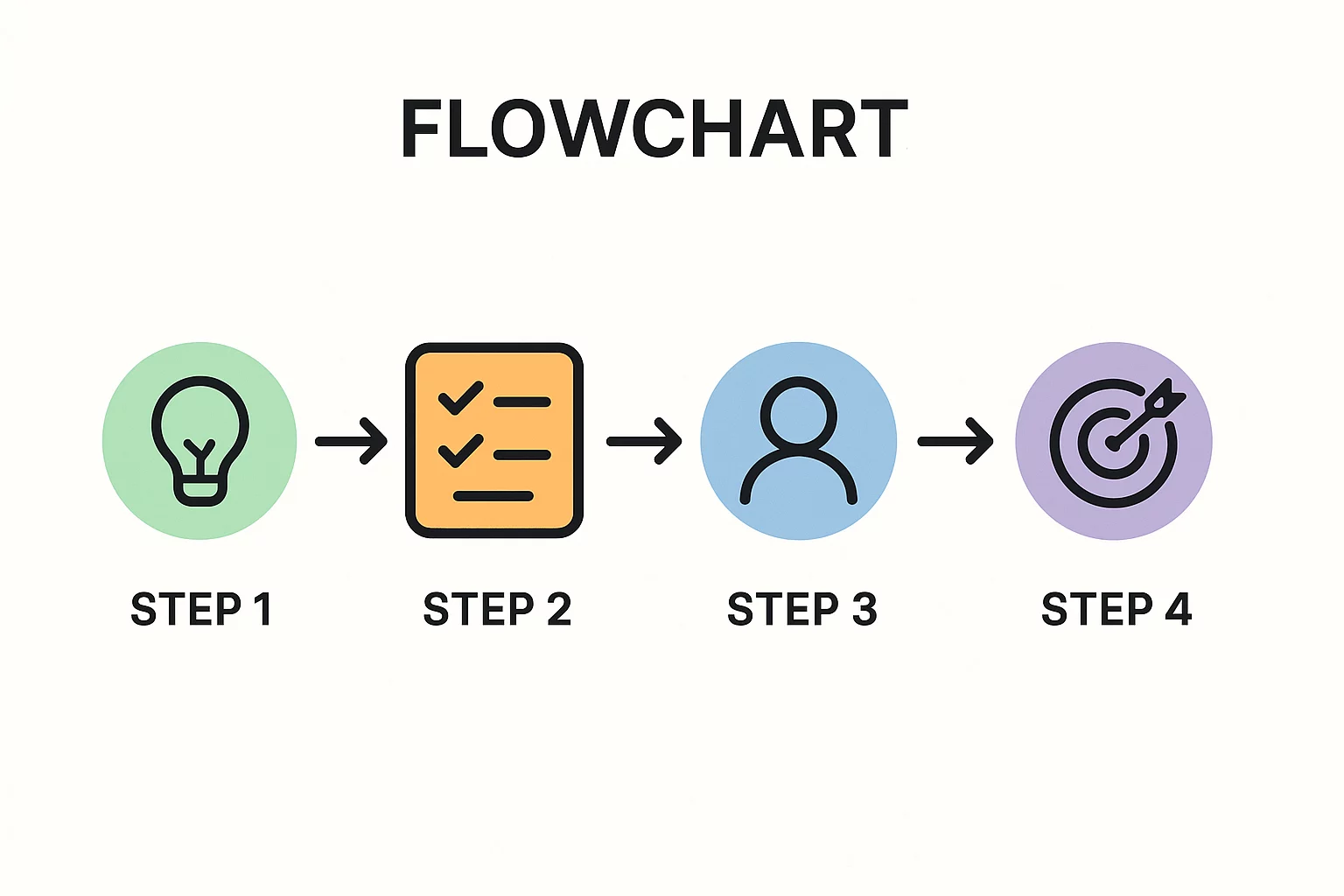

Step 1: Start with a Solid Baseline

Before you can measure the impact of incentives, you need a clear and realistic financial model without them. This baseline must include detailed projections for your initial investment, ongoing operational costs, and expected revenues. Building this baseline requires a firm grasp of your core expenses, including a detailed breakdown of your solar panel manufacturing costs, to serve as a reliable benchmark.

Step 2: Model Each Incentive Separately

Next, apply each potential incentive to your baseline model to see how it changes the numbers.

- For a Capital Grant: Subtract the grant amount directly from your initial CapEx. This will immediately reduce your total investment.

- For a Tax Holiday: In your profit and loss projection, set the corporate tax rate to zero for the specified number of years. You will see a direct increase in your net profit during that period.

- For a Production Subsidy: Add a new line item to your revenue projections, calculated as (subsidy per unit) x (projected annual production).

Step 3: Recalculate Your Key Metrics

With the incentives modeled, recalculate your primary financial indicators. You should focus on two key metrics that are most important to investors and financial partners:

- Payback Period: The time it takes for your net cash flow to equal your initial investment. With reduced CapEx and higher profits, this period will shorten significantly.

- Internal Rate of Return (IRR): This metric represents the total long-term profitability of the project. A higher IRR demonstrates a more financially attractive venture.

The J.v.G. Perspective: A Partner for the Full Picture

Over more than 25 years of building solar factories across the globe, we have learned that the most successful projects are not just technically sound, but are built on a robust and realistic financial foundation. The initial business case is as critical as the engineering plan.

Navigating different regulatory and financial environments requires experience, and the journey from a promising idea to a profitable factory involves many complex steps. Our experience with turnkey solar production lines extends beyond the machinery; we help our clients ask the right strategic questions right from the start to build a business that is viable for the long term.

Frequently Asked Questions (FAQ)

Are government subsidies guaranteed?

No. Incentives are typically not automatic. They almost always require a formal application process, a detailed business plan, and ongoing compliance with specific requirements, such as job creation or production targets. They can also be subject to political or policy changes.

Where can I find information about incentives in my country?

The best places to start are national or regional investment promotion agencies, ministries of trade and industry, or energy ministries. Engaging with local business consultants or legal advisors who specialize in this area is also highly recommended.

How complex is the application process?

The complexity varies greatly by country and by the type of incentive. Simple tax credits may be straightforward, while large capital grants often require a comprehensive and competitive application process that can take several months.

Should I develop a business plan before I know the exact incentives available?

Yes. First, develop a baseline financial model assuming no incentives. This proves the fundamental viability of your project. You can then create several additional scenarios (conservative, realistic, and optimistic) based on the incentives you believe you can secure.

Your Next Step: From Calculation to Conversation

A solid financial model is the foundation of any successful manufacturing venture. Understanding and integrating the full impact of local government incentives is a critical part of building that model. This transforms your business plan from a simple projection into a strategic tool for securing investment and accelerating your path to profitability.

If you are ready to explore the possibilities for your project, we are here to help you navigate the process. Contact us to start the conversation.