Imagine you’ve secured the land, identified a strong market, and have a vision for a state-of-the-art solar module factory. While this vision is the engine, the next question is about the fuel: How do you structure the financing to not only build the facility but also ensure its long-term viability?

The choice between debt and equity is more than a line item on a spreadsheet—it’s the financial architecture that shapes your project’s resilience, profitability, and ultimate success. For serious investors, understanding this balance is the first step in turning a powerful idea into a bankable reality.

Understanding the Two Pillars of Financing: Debt and Equity

Every major industrial project rests on two financial pillars: equity and debt. Grasping the role of each is essential to designing your financial strategy.

Equity: Your Stake in the Venture

Equity is the capital invested by you and your partners, representing ownership. This is the ‘skin in the game’ that demonstrates your commitment to the project.

- Source: Your own funds, private investors, or venture capital.

- Cost: No mandatory monthly payments. The ‘cost’ is a share of future profits and a dilution of your ownership.

- Lender’s Perspective: A significant equity contribution reassures banks that you are confident in the project and are sharing the risk.

Debt: The Capital You Borrow

Debt is capital loaned to you by an institution like a bank or a development fund, which must be paid back with interest over an agreed-upon period.

- Source: Commercial banks, development finance institutions (DFIs), or government loan programs.

- Cost: Regular interest and principal payments (debt service).

- Lender’s Perspective: Lenders are not owners. Their primary concern is the project’s ability to generate enough cash flow to reliably repay the loan.

A common starting point for industrial projects is a 70/30 debt-to-equity ratio. However, the optimal mix for your solar factory will depend on your region, business plan, and the project’s perceived risk.

The Power of Leverage: A Double-Edged Sword

Using debt to finance a portion of your project is known as leverage. When used wisely, it can significantly amplify the return on your equity. The bank’s capital allows you to undertake a much larger project than your equity alone would permit, leading to greater potential profits.

However, leverage also increases risk. Each loan payment is a fixed obligation that must be met, even if your factory’s revenues fall short. An overly aggressive financing structure with too much debt can place immense pressure on your early operations and leave little room for unexpected challenges. The key is finding a balance that maximizes opportunity while maintaining a robust financial buffer.

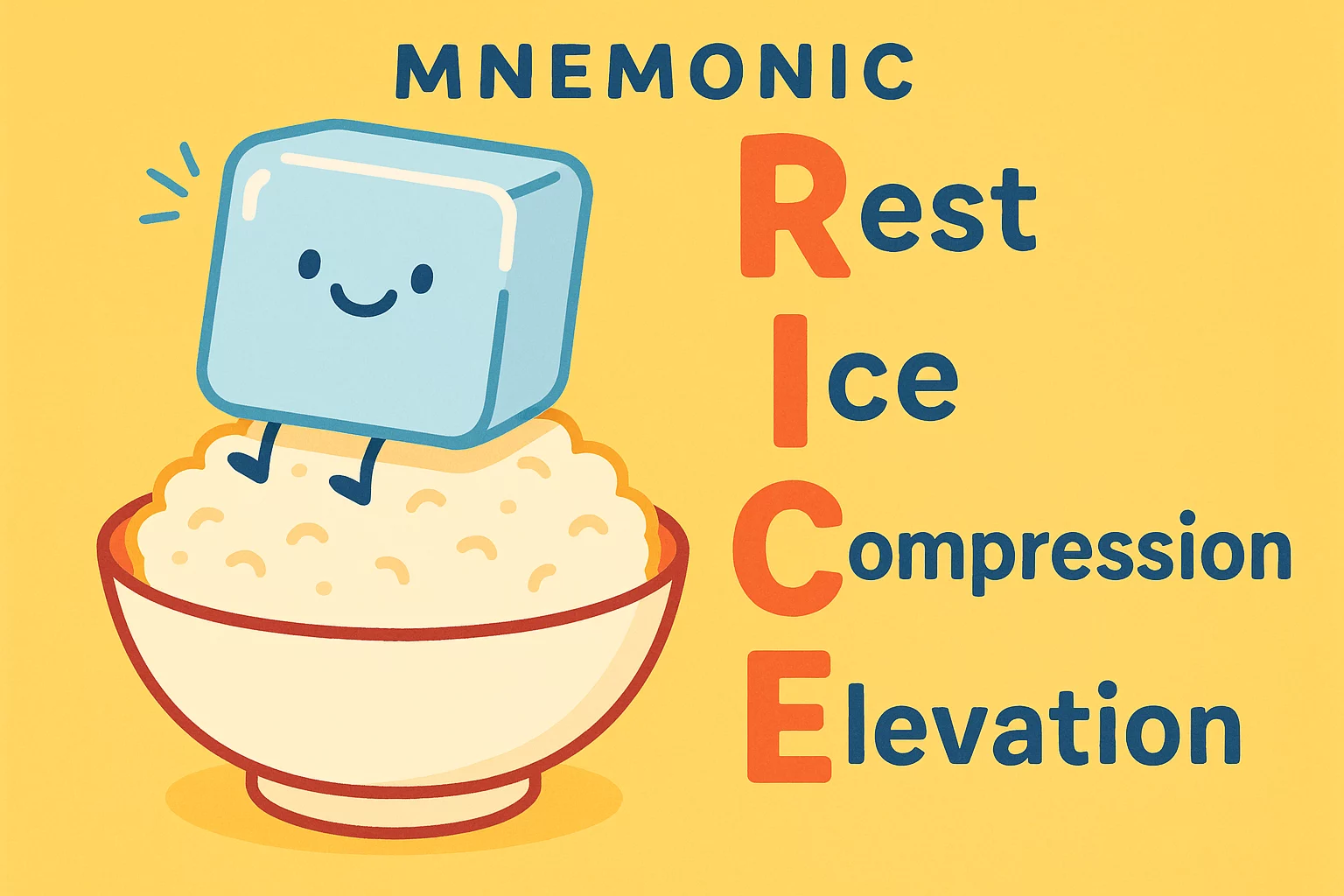

Speaking the Language of Lenders: The Debt Service Coverage Ratio (DSCR)

When you approach a bank for a loan, they will evaluate your project’s financial health. Their most important metric is the Debt Service Coverage Ratio (DSCR).

In simple terms, the DSCR answers one question: Does your project generate enough cash to comfortably cover its loan payments?

The formula is: DSCR = Net Operating Income / Total Debt Service

- Net Operating Income: Your revenue minus operating expenses (before loan payments).

- Total Debt Service: The total of all principal and interest payments due over a period.

A DSCR of 1.0 means you have exactly enough income to cover your debt, which is far too risky for any lender. Financial institutions typically require a DSCR of at least 1.25 or higher. A ratio of 1.25 means your project generates $1.25 in cash for every dollar you owe. This 25% surplus provides a crucial safety margin.

A strong DSCR is non-negotiable for securing financing. It signals to lenders that your project is not just visionary but also financially sound and professionally planned.

How Your Technical Partner Influences Your Financial Structure

Lenders finance projects, not just ideas. They need to see a detailed, credible business plan built on realistic production forecasts, reliable technology, and proven operational expertise. This is where your choice of a technical partner becomes a critical financial decision.

An experienced engineering partner does more than supply machines; they provide the data and instill the confidence that banks require.

- Bankable Business Plans: A partner with decades of experience can provide proven financial models and accurate production forecasts—the foundation of your loan application. Our Turnkey Approach is designed to give lenders this confidence from day one.

- De-Risking the Project: By guaranteeing production capacity and equipment performance, a trusted partner removes significant technical risk—a major concern for any lender.

- Credibility and Trust: A global track record of success adds immense credibility. It’s not just about the machines but the expertise of the people standing behind them. When the founders of your technical partner have over 25 years of real-world experience, lenders take notice.

The right partner transforms your project from a speculative venture into a calculated investment in the eyes of a bank. This directly influences the financing terms you can secure, from interest rates to loan amounts.

Frequently Asked Questions (FAQ)

What is a typical debt-to-equity ratio for a new solar factory?

While a 70% debt and 30% equity structure is a common benchmark for industrial projects, the final ratio depends on factors like market stability, the experience of the project team, and the strength of the business plan. In emerging markets, lenders may require a higher equity contribution to mitigate perceived risk.

Why is a high DSCR so important to banks?

A high DSCR provides a safety cushion. It shows the bank that your factory can withstand unforeseen circumstances—such as a temporary drop in sales or a rise in material costs—and still meet its loan obligations. It’s the primary indicator of your project’s financial resilience.

Can I finance 100% of my project with debt?

No, this is highly unlikely and not advisable. Lenders require a significant equity investment from project owners. This ‘skin in the game’ ensures you are fully committed to the project’s success and are sharing the financial risk. Without equity, the project is considered too high-risk for nearly any financial institution.

How does a turnkey factory solution help in securing financing?

A turnkey solution provides a complete, integrated, and performance-guaranteed production line. This simplifies the project and removes many variables that create risk. For a bank, a turnkey contract with an experienced partner like J.v.G. means proven experts are managing the technical and operational aspects, making the project far more ‘bankable.’ The entire process, from initial design to full operation, is outlined in how we work with our clients.

Building Your Project on a Solid Foundation

A successful solar factory is built on two pillars: technical excellence and a sound financial structure. Understanding how to balance debt and equity is as critical as choosing the right technology. Creating a conservative, realistic financial plan and partnering with a team that brings decades of experience presents a project that is not only visionary but also fundamentally secure.

This thoughtful approach is what transforms a business plan into a thriving industrial asset and turns investors into market leaders.

Ready to build a financially sound project? Contact us to discuss your vision and turn it into a bankable reality.